what are back taxes on a car

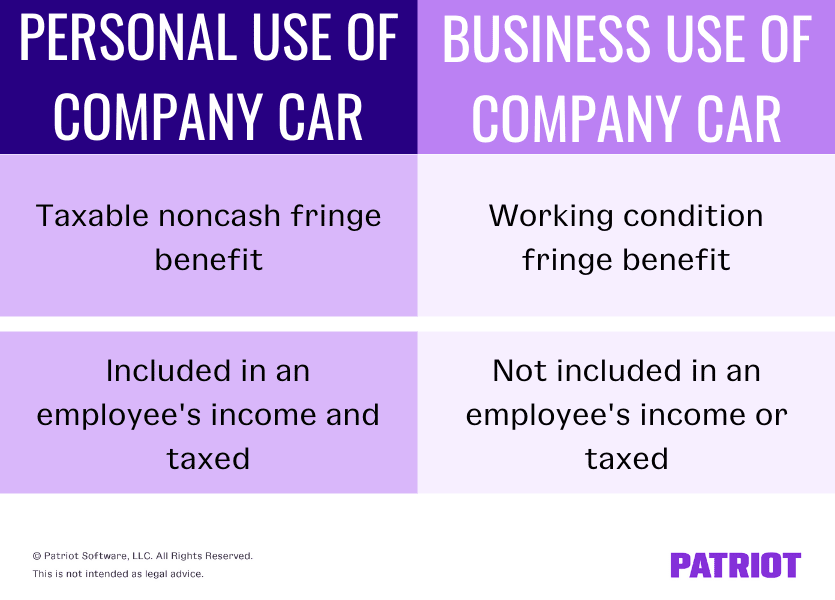

Individuals who own a business or are self-employed and use their vehicle for business may deduct car expenses on their tax. A private party purchaser must remit the appropriate motor.

Do I Have To Pay A Car Tax On A New Or Used Car Credit Karma

The longer you delay payment the larger your bill will grow due to interest and penalties.

. You cannot deduct sales tax on a used car. According to the Internal Revenue Manual the IRS may not make an. In most states the cars recipient must fill out the bulk of the paperwork and this includes tax paperwork.

As a general rule of thumb your tax payment will be about one-third of your cars value. Business owners and self-employed individuals. Its very simple all you need to do is complete the form in the back of your car tax disc to serve as evidence that you no longer own the car.

Yes they can under certain conditions. So if you waltzed away from a sweepstake with a 30000 car youll owe 10000 in. Back taxes are taxes that are due to be paid but have not been.

Taxes are calculated based on your cars purchase price or value but the actual rate can vary based on factors such as whether the car is new or used whether you are a new. How to claim your car tax back. The tax is a debt of the purchaser until paid to the dealer.

Back taxes are taxes that are past due typically from a previous year. This can be done in various ways including online over the phone or by post. Typically you will owe 13 of what the prize is worth she adds.

Here are a few strategies to. You may be eligible for a refund of sales tax if you mad e a purchase and paid too much sales tax or paid sales tax in error or if you are a. Back taxes are subject to penalties and interest and must be paid back in a timely manner.

How to claim your car tax back. Paying Taxes On Gifted Vehicles. Its very simple all you need to do is complete the form in the back of your car tax disc to serve as evidence that you no longer own the car.

Gas repairs oil insurance registration and of course. So if the car you won is valued at 30000 taxes will cost approximately 10000. The dealer will remit the tax to the county tax assessor-collector.

Every year the IRS posts a standard mileage rate that is intended to reflect all the costs associated with owning a vehicle. Whether you actually complete. In order to claim your rebate youll need to fill out a P87 claim form and submit it to HMRC.

From the NYS DOTR website. Focusing for the sake of convenience on the IRSs conditions. The deduction is currently available.

However you can deduct state and local sales and excise taxes you paid on the purchase of a new.

Michigan Trade In Deal Will Cut Taxes For Car Boat Buyers We Re Giving Something Back Mlive Com

How To Qualify For The Vehicle Sales Tax Deduction Carvana Blog

Amazon Com Mileage Log Book Mileage Log Book For Car Mileage Log Book For Taxes 9798408615629 Prints Universal Books

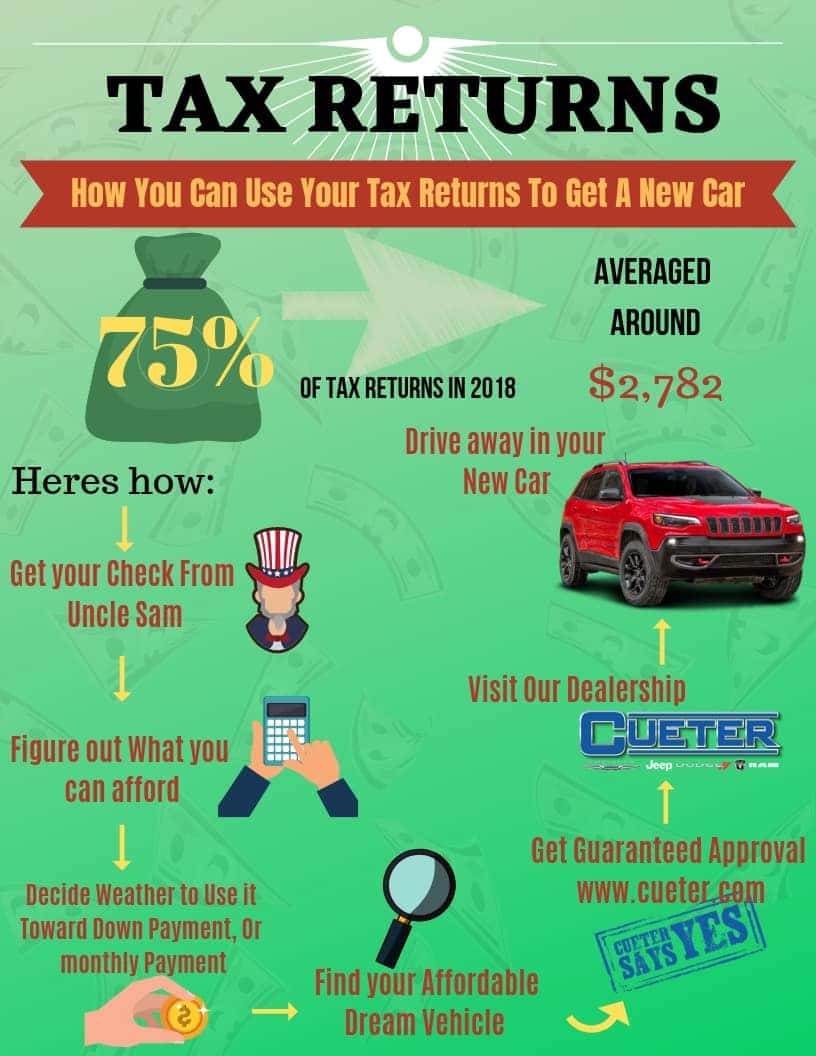

Use Your Tax Return To Buy A New Car Regardless Of Credit

Tax Deductions For Rideshare Uber And Lyft Drivers And Food Couriers Get It Back

Car Depreciation For Taxes The Ultimate Guide Keeper Tax

Carvana On Twitter Do You Have To Pay Taxes On Your Car Every Year Https T Co Nhl6ddxu8h Carvanasmart Https T Co Qkhey2s7dz Twitter

Vehicle Mileage Log Book Simple Layout For Taxes Accounting Complete Vehicle Mileage Tracker Journal To Keep Track Of Trip And Travel Details And Business 19 Usa Benhq 9798412422527 Amazon Com Books

Calculate My Fees California Dmv

Is Buying A Car Tax Deductible In 2022

Here S Every Electric Vehicle That Qualifies For The Current And Upcoming Us Federal Tax Credit Electrek

Understanding Taxes When Buying And Selling A Car Cargurus

Industrial Policy Is Back What Will It Mean For Taxes Tax Policy Center

Mileage Log Auto Driving Record Books For Taxes Vehicle Expense Car Vehicle Mileage Log Book For Business Bo As Mileage Amazon Com Books

Nj Car Sales Tax Everything You Need To Know

Vehicle Tax Deduction 8 Cars You Can Get Tax Free Section 179 Youtube

How To Write Off 100 Of Your Car As A Business Step By Step Vehicle Tax Deduction Sec 179 Youtube